Buying your first home is an important milestone in one’s life. For many Filipinos, to be able to afford a home means many things. For one, it means one has enough maturity to be able to manage one’s own home. But besides personal maturity, it also entails a lot of financial maturity. You may be a master of household chores, cooking, doing the laundry, etc, but paying for a home is a whole different game. If you feel lost in terms of the financial side of purchasing a property in the Philippines, fear not. Here are some of your money-related questions answered:

Buying Your First Home: 4 Questions to Financially Prepare for It

1. How can I actually afford a home?

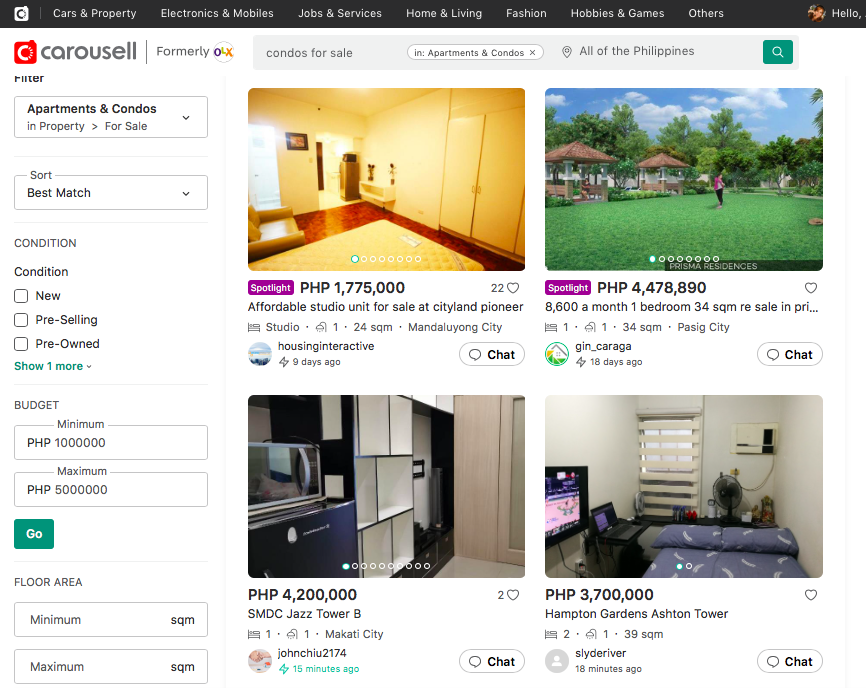

It’s no secret that purchasing a property does not come cheap. It may even be the largest purchase one can make in their adult life. One look at sites like Carousell shows that houses, condominiums, and townhouses, easily cost millions of pesos, depending on the location.

This is why many financial institutions offer home loans. In general, loans fall under a class of financial service known as “financing.” The idea of financing is that a financial institution like a bank helps you make a very expensive purchase by paying a large portion of the cost upfront so you can make use of it already. The financial institution becomes what’s called your lender which you have to pay back over time.

Let’s say you want to purchase property worth Php 2 million. You find a bank who will let you take out a home loan such that they pay Php 1.8 million to the property owner you’re buying from while you take care of the Php 200,000 down payment. The Php 2 million taken care of, the property owner will happily hand you the keys to your new home. You now owe the bank and pay them back over the next few years.

Suggested post: Compute the right budget you can afford with our home calculator

2. What should I watch out for if I take out a home loan?

As a service, financing also entails cost which takes the form of interest. So in our previous example, you don’t actually owe the bank just the Php 1.8 million they shelled out. You will be paying back both how much you borrowed, which is called your principal, and interest.

Before you take out a home loan, you will be given a computation, usually called a “payment schedule,” where you’ll see how much you will have to pay back over time. The total amount of time you will be paid back is called the “loan term” which more or less ranges from 10 to 30 years.

Tip: One way you can lower the overall interest you have to pay is by asking for a shorter loan term. In general, the shorter the term, the lower the interest will be.

Note however that many loans can have periods where the interest is at a “fixed rate” and when it’s at a “floating rate.” When a loan is at a fixed rate, it means the interest you’re being charged stays the same. On the other hand, a floating rate means the interest you’re charged goes up or down.

Suggested post: Benefits of taking a home loan in the Philippines

What this means for you is that loans can have arrangements where the loan is fixed for the first few years and then is floating for all the years after. For example, your Php 1.8 million loan has a term of 30 years, a fixed interest rate of 10% for the first 10 years only. This means after the first 10 years, the interest you pay stays the same but then changes in the last 20 years.

Are floating rates good for you? It depends. It’s possible for a loan’s interest rate to actually lower depending on the overall market rate which is affected by many factors, the Bangko Sentral ng Pilipinas, chief among them. However, the opposite is also true, so mileage may vary.

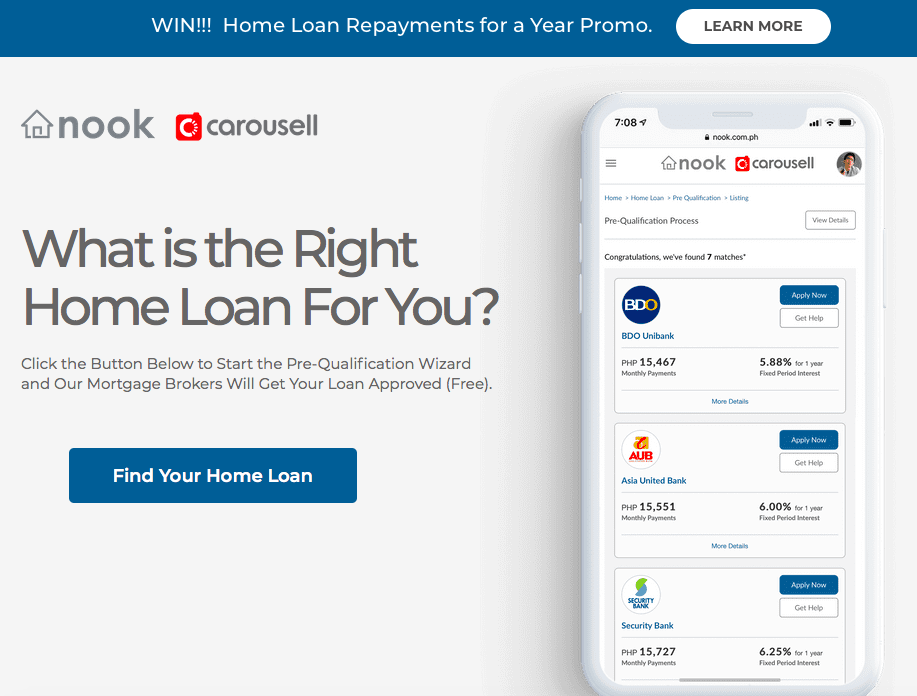

If you’re looking for an easy way to apply for a home loan, try applying for one from our friends at Nook!

3. What happens if I can’t pay my home loan?

When you’re paying back a loan, you do so over time, usually on a monthly basis. These monthly payments are called amortizations. In general, you want to be able to afford your amortizations without sacrificing your budgets for everything else. The last thing you want is to starve yourself just so you can afford a home.

Suppose you run into some financial trouble and can’t afford your amortizations. Depending on which lender you’re borrowing from, many things can happen. Some will be more forgiving than others. However, missing loan payments means you will have to pay more in interest overall so avoid missing payments as much as possible.

If you miss a certain number of payments, your lender can seize your property. For example, if you stop paying the bank you borrowed from for 6 months, they are allowed to foreclose your home and put it on sale so they can recover their losses.

If you really can’t make your payments because of very serious financial trouble, you might want to consider what’s called a loan restructuring. This is when you tell your lender that you need some breathing room from your debt. This can lead to your loan term being extended or you’re given a few months where you don’t need to make payments with no additional interest being charged.

Note that a loan restructuring will affect your ability to take out loans in the future. Furthermore, some lenders might be more inclined to foreclose your property sooner. If you must ask for a loan restructuring, you have to make sure you do not appear pitiful. When asking for a loan restructuring, you’re trying to reassure your lender that you will pay them back because your current financial troubles are only temporary.

4. What if I saved up for a home instead?

With so many stipulations to taking out a loan, you might be thinking it’s probably better to just save up for a home instead. While this is possible, there are many factors that make this very difficult.

First is the massive amount you will have to save over time to afford a property with your own money. Unless you have copious amounts of cash, you will have to save and maybe invest for several years first. If you choose to take this route, then time becomes your enemy because by the time you can afford the price you set, the property may have increased in value.

Second is a financial concept known as opportunity cost. Let’s say you do have Php 2 million and use it to purchase the property. What if you also needed to purchase a car? Worse, what if you ran into financial trouble? By shelling out a huge amount of money, you greatly limit your financial flexibility.

Finally, purchasing a home is not the end of your expenses. There are additional expenses to consider, such as property taxes. You may be able to purchase the property immediately, but then what if the home needs renovation? What if you need to purchase new furniture for it? Then there’s also the question of monthly expenses. In general, everyone should have at least 6 months’ worth of expenses ready in an emergency fund. How can you know how much your monthly expenses will be in your new home if you’re just moving in?

Buying Your First Home: What else do I have to know?

By now, you can tell why buying your first home takes a lot of financial maturity. Besides being financially stable, there are many financial concepts you need to have a grasp of to make sure you can find the best possible deal for your first home. Luckily, once you’re ready, you can easily find the property for you on sites like Carousell. Not only can you find plenty of houses and condominiums for sale, you can also find lots and foreclosed properties that could potentially let you save while offering you flexibility of developing the home for yourself.

Good luck, prospective home buyer!